OPINION: Ocasio-Cortez 70% multi-millionaire tax rate would help correct tax disparity

New York Rep. Alexandria Ocasio-Cortez drew conservative ire on Jan. 6 when she suggested a 70 percent marginal tax on people with income over $10 million in an interview with “60 Minutes.”

Angela Morabito, a writer for the National Examiner, wrote that this plan was “worse than actual socialist countries.”

“She wants people taxed as high as 89, 90 percent if you make $10 million or more, where she calls them the tippy top,” Fox & Friends co-host Brian Kilmeade said on-air.

Among opponents of this idea, there seems to be the idea that Ocasio-Cortez’s plan would apply the 70 percent tax to the entirety of a millionaire’s income. This is emblematic of a seemingly widespread misunderstanding of taxation.

What Ocasio-Cortez suggests is a marginal tax rate, which is different than a flat tax. The 70 percent marginal tax would apply only to any dollar made over $10 million.

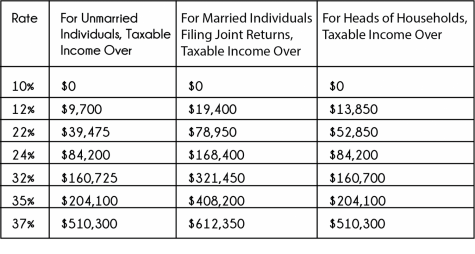

This is how the U.S. tax system works. Depending on how high your income is, you’ll be placed into a bracket that determines how much you’ll be taxed. Your bracket is determined not only by how much money you make, but also for what status you file under. There’s single, married filing jointly, and head of household.

This doesn’t mean you’re paying the tax rate for that bracket on your whole income, just for income falling into that bracket.

Say you make $75,000 in 2018 and your filing status is single. You would fall in the 22 percent bracket. You wouldn’t pay 22 percent on all of it, instead you would pay 10 percent on the first $9,525, 12 percent on anything between $9,526 and $38,700 and 22 percent on the rest. In total, you pay $9,800 as opposed to $16,500 if it were a flat tax.

This puts your effective income tax rate at around 13 percent. Now, you will also have to pay state income tax and payroll tax, which includes Social Security and Medicare. Overall, Your tax burden would be somewhere between 25 to 30 percent of your income.

In 2017, the Tax Foundation found that the average American family’s total tax burden was 31.7 percent of their pretax earnings. In contrast, Warren Buffett, one of the richest men in the U.S., reported that his 2010 income tax bill was only 17.4 percent of his taxable income in a New York Times Op-Ed.

Buffett attributes this to a myriad of tax breaks and loopholes instituted by the federal government. This wasn’t always the case, with top-earners once paying 90 percent on the top part of their income, but ever since Reagan took power and signed in the Tax Reform Bill of 1986, the federal government has focused on “protecting” the ultra-wealthy.

In 2017, the Spectrum Group found that less than 10 percent of American households make more than $1 million each year.

Researchers Emmanuel Saez and Gabriel Zucman found that the top .01 percent of American families make almost as much money as the bottom 90 percent. One hundred and sixty thousand families have the same amount of wealth as 144.6 million families.

Wealth inequality in the U.S. is obscene. No one needs that amount of money, and the fact that they pay a lower effective tax rate is even worse. A cup of water means nothing to a man with a well, but everything to a man in the desert.

Multi-millionaires shouldn’t be carrying a lighter load than the average American. What Ocasio-Cortez suggests isn’t insanity, but a return to reason for the U.S.

We hope you appreciate this article! Before you move on, our student staff wanted to ask if you would consider supporting The Appalachian's award-winning journalism.

We receive funding from the university, which helps us to compensate our students for the work they do for The Appalachian. However, the bulk of our operational expenses — from printing and website hosting to training and entering our work into competitions — is dependent upon advertising revenue and donations. We cannot exist without the financial and educational support of our fellow departments on campus, our local and regional businesses, and donations of money and time from alumni, parents, subscribers and friends.

Our journalism is produced to serve the public interest, both on campus and within the community. From anywhere in the world, readers can access our paywall-free journalism, through our website, through our email newsletter, and through our social media channels. Our supporters help to keep us editorially independent, user-friendly, and accessible to everyone.

If you can, please consider supporting us with a financial gift from $10. We appreciate your consideration and support of student journalism at Appalachian State University. If you prefer to make a tax-deductible donation, or if you would prefer to make a recurring monthly gift, please give to The Appalachian Student News Fund through the university here: https://www.givecampus.com/campaigns/54088/donations/new?designation_id=faa93386&

Jared Wolbert • Jan 24, 2019 at 8:11 am

Who are you to tell anyone how much money they need? And why do you think the government is entitled to it?

The core of the issue is the people with the most money, employ the most people. When you take away a huge portion of the motivation to have over 10 million dollars, far less people from an already small pool will be inclined to do it in THIS country. Do you know what they will do? They’ll start operating there business in other countries. But don’t worry, they’ll still sell products in the USA and make money of off American’s, creating the net effect of less money in the hands of Americans. That seems like a great idea for the long-term health of our economy.

It is insanity. It’s socialism once removed from communism. Demonizing the rich is the first move. Do some research on dekulakization in the Soviet Union.