Your guide to unemployment filings amid COVID-19

April 13, 2020

As restaurants, schools and businesses close to fight the spread of the coronavirus and flatten the curve, many North Carolina residents are left without a source of income.

From March 16 to April 9, there have been 444,178 COVID-19 related unemployment insurance claims, according to the North Carolina Division of Employment Security. Complications accessing the online benefits system and over the phone have soared over the last few weeks due to an overwhelming amount of claims.

Lockhart Taylor, assistant secretary for employment security, presented new measures being taken at the April 2 media briefing. Call center hours have extended to 8 p.m. on weekdays alongside limited Saturday hours. The DEC is hiring a new 50 employees, utilizing 100 employees from the North Carolina Division of Workforce Solutions Career Centers and utilizing a third-party call center for an additional 200 call center workers.

When all initiatives are complete, a total of about 850 workers will be dedicated to processing unemployment benefit claims. The reality of unemployment is heightened alongside the severity of the pandemic for many.

“We will not rest until we have processed every request and gotten checks to every eligible recipient in our state,” Taylor said in the briefing.

FAQs

How do I file a claim?

The fastest way is to create an account and file online at des.nc.gov With an online account, you can also complete weekly certifications and check a claim status. You can apply for benefits online 24 hours a day, seven days a week. Steps to create an online account can be found here. You can also contact the customer call center toll free at 888-737-0259. When filing due to COVID-19, select “Coronavirus” as your reason for separation.

What do I need to file my claim?

To file a claim you will need your Social Security number, information about your most recent employment and pay, your work history for the last two years and your bank routing and account numbers for a direct deposit.

What is an attached claim?

An attached claim is a claim filed by an employer on behalf of the employee who has been temporarily laid off. If an employer refuses to file on your behalf, you must file your own claim and meet all eligibility requirements.

What are weekly certifications?

Weekly certifications, or a weekly claim for benefits, are a series of questions that verify you are able, available and looking for work during a given week. After submitting an initial application, begin filing weekly certifications the week after, even while waiting to learn of your eligibility for benefits. To receive unemployment insurance payments, you must file a weekly certification within 14 days after each week of unemployment. Beginning March 20, weekly certifications for benefits must be submitted online and no longer by phone.

What if I don’t complete a weekly certification?

Failure to complete a timely weekly certification will result in a missed week of payment and require you to reopen your claim and serve an additional non-payable week.

How long does it take to receive unemployment benefits?

Payment is typically received within about 14 days of filing an initial claim, as long as there are no issues, like filling the application out incorrectly, with the claim. After filing a claim, your last employer is given 10 days, by law, to respond to DES about your claim, and no payment will be released until after this 10-day period. You will receive payments by direct deposit or debit card. If you have not received payment within 14 days after your weekly certification is filed and think it is late, contact DES by email at des.ui.customerservice@nccommerce.com Take note that due to COVID-19, many are reporting an extensive wait time, largely due to the overwhelmed system. Be prepared to possibly face a longer waiting period after filing an initial claim and continue to contact DES with any issues.

Are independent contractors eligible?

Both independent contractors and those self-employed are not typically eligible for unemployment insurance benefits. These individuals may qualify however for federal Pandemic Unemployment Assistance. The Division of Employment Security is currently awaiting guidance from the federal government to begin implementing the Pandemic Unemployment Assistance program. Check https://des.nc.gov/ for updates.

What is a base period?

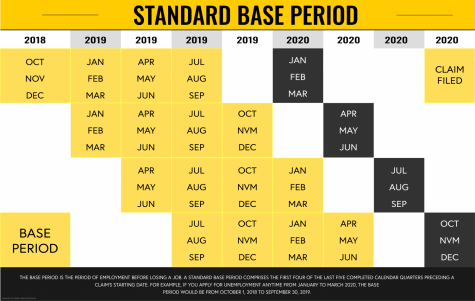

A base period is the time frame used to determine monetary eligibility to receive unemployment payments. It normally includes the first four of the last five completed calendar quarters.

The base period is the period of employment before losing a job. A standard base period comprises the first four of the last five completed calendar quarters preceding a claim’s starting date. For example, if you apply for unemployment anytime from January to March 2020, the base period would be from October 1, 2018 to September 30, 2019.

What is an alternative base period?

If lacking enough sufficient wages in the standard base period, DES may qualify the claimant for benefits with an alternative base period. The alternative base period consists of the last four completed calendar quarters preceding the starting date of a claim.

Are part-time employees eligible?

Part-time employees may qualify for unemployment benefits only if they earned enough money in their base period to receive benefits. The individual must have earned wages in at least two quarters of the base period, and earned wages totaling at least six times the average weekly insured wage in the base period. Currently, six times the average weekly insured wage equates to $5,818.50.

What does it mean if my claim is “pending”?

A “pending” status for a claim means that the Division of Employment Security is awaiting to hear from your former employer. By law, employers have 10 days to respond and no unemployment payments can be made during this period. If your employer does not respond and you have “Coronavirus” selected as the reason for filing, the system will adjudicate the issue automatically. If all requirements are met and you are completing all weekly certifications, DES will pay benefits. The employer will be notified of this determination of benefits by mail. If the employer feels the claim is not valid, they have the option to appeal the determination.

How do I find out my weekly benefit amount? How can I protest the determination of my weekly benefit amount?

After filing a claim, you will receive a Wage Transcript and Monetary Determination form by mail. This form shows your quarterly wages paid each base period and your monetary eligibility, including your weekly benefit amount, duration of benefits and effective date of your claim. If you are found ineligible for a weekly benefit, the reason will be stated on the form. Monetary eligibility is determined by working and earning enough wages within your base period to meet the requirements for establishing a claim. In order to receive benefit payments, you must also meet additional requirements, such as completing your weekly certifications. If you believe wages are missing or listed inaccurately on the form, you may file a protest within 10 days from the mailing of the Wage Transcript and Monetary Determination form, postmarked. File your protest by mailing it to P.O. 27967, Raleigh, NC 27611-7967 or faxing it to 919-857-1296. Include a copy of the form with an explanation of your protest and proof of wages that you believe were incorrectly reported.

Gov. Roy Cooper’s Executive Order No. 118 expanded unemployment insurance in response to the COVID-19 pandemic. The order addresses those who, because of the novel coronavirus, have temporarily lost their job, have reduced work hours, cannot work due to a medical condition caused by COVID-19, or communicable disease measures, like limited office staff.

The following changes have been made.

- Employees who have lost their jobs or have their hours reduced due to COVID-19 are eligible to apply for unemployment benefits.

- The weeklong waiting period without payment is waived for those filing as a direct result of COVID-19.

- Employers will not be held responsible for benefits paid as a direct result of COVID-19.

- Workers are not required to be actively looking for another job when potential employers are closed and social distancing guidelines remain. Workers are still expected to job search when they can, remotely. Employers hiring employees back after the pandemic subsides are not required to job search. If you are filing a claim due to COVID-19, you may answer “yes” to the question on the weekly certification: “Did you look for work?”

The North Carolina Division of Employment Security addressed complications in a recent FAQ document. DES said they are aware of issues in accessing online accounts and stay on long hold times over the phone. DES will begin the claim with the week the claimant initially attempted to file so no one misses out on any weeks of eligibility. Locked accounts will automatically unlock after 30 minutes. After the 30 minutes, try to sign in again or reset the password. For other issues with passwords and PINs, email NCDESpasswordhelp@nccommerce.com.