In September 2007, Watauga County began construction on a new high school, a project that ultimately led to a change in the distribution of sales tax in Watauga County in 2013. The change has cost Boone a total of $49 million, according to Amy Davis, Boone’s town manager, and since then, the county and town have faced ongoing disagreements, including a lawsuit, regarding sales tax that mirrors another from 1987.

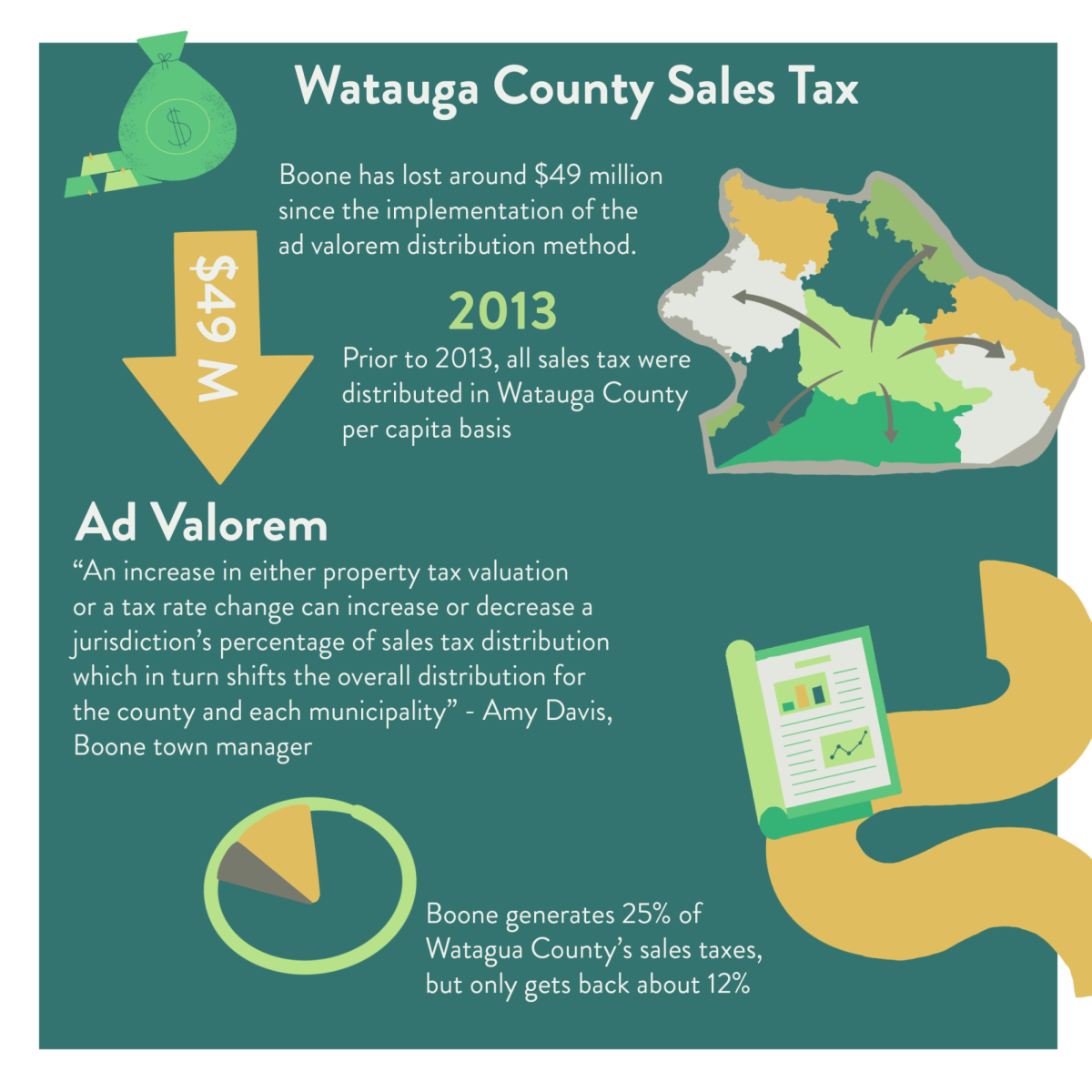

Prior to 2013, Watauga County distributed sales tax based on a per capita method. The county switched to an ad valorem method at a County Board of Commissioners meeting on April 16, 2013. An ad valorem tax distribution method means that money is being distributed based on property value. They signed that the resolution go into effect beginning in the 2013-14 fiscal year, and remain in effect unless changed by another resolution.

“For the ad valorem method, an increase in either property tax valuation or a tax rate change can increase or decrease a jurisdiction’s percentage of sales tax distribution which in turn shifts the overall distribution for the county and each municipality,” Davis said.

Davis, a lifetime resident of Watauga County, has been working for the town since 2004.

Town council member Edie Tugman said Watauga High School’s newest building was built 13 years ago. This building is off Highway 421. The construction project created a free space where the old building once was, located at 400 High School Drive.

“That property was a very valuable asset for the county,” Tugman said.

On May 6, 2013, Phil Templeton of Templeton Properties addressed a letter to Deron Geouque, county manager, withdrawing Templeton Properties offer of $18.9 million. The letter reads, “Regulations prohibiting buildings large enough to accommodate Target or other retailers as well as other restrictive provisions such as Tree Preservation, Retaining Walls, Viewshed and Steep Slope ordinances were also contributing factors.”

Watauga County transferred ownership of the property to App State on Sept. 29 2017. According to App State’s Future, a 34-acre portion of the property used to be home to Watauga High School’s track, softball field, and tennis court. This property has been subdivided to become new athletic facilities. App State has also explored options like student housing, a day care facility and student recreation fields.

Tugman explained the land was less valuable to the county as smaller development pieces than as one big piece.

“They changed the sales tax distribution,” Tugman said.

“Our corporate limits are significantly smaller; we have less options to make up the loss of income,” Tugman said. The Town of Boone has 4959 tax parcels, and 401 that are exempt.

Prior to the decision made in 2013, all sales tax were distributed in Watauga County on a per capita basis. Per capita means the percentage that each town makes up of Watauga County’s population is the percentage they get back in sales tax.

The county now receives money via an ad valorem distribution method.

“The burden of things like sidewalks and street lamps and police enforcement and fire enforcement, all of those things come out of the tax that is generated by the town,” Tugman said.

As a result of this, Boone loses around $4.6 million annually, resulting in about a $49 million total loss since the implementation of the ad valorem distribution method. According to the North Carolina Department of Revenue, Boone generates 25% of Watauga County’s sales tax, but only gets back about 12%.

“We have street maintenance, we have water and sewer and storm drain runoff that we are responsible for, and those are all very expensive things that the town has to do, and yet we do not feel like we can take our property tax higher,” Tugman said.

Davis said having 20,000 residents and an additional 20,000 students places a demand on infrastructure.

“As far as the tax-payer, they’re entitled to services from us, and we could probably fill a page with things that our citizens would like to have,” Davis said. “But with a year-to-year loss of four and a half million dollars it really cuts into our ability to do that.”

According to other local politicians, however, there is a benefit to the ad valorem method.

Todd Castle, a Watauga County commissioner since 2022 and IT employee of App State football, said the only population that the per capita method benefits is the Town of Boone. He said places like Blowing Rock and Beech Mountain would suffer if it weren’t for ad valorem.

Castle said other places “still get the distribution of money, but it helps rural fire departments and some of these small communities get more money.”

He notes that while he is a Republican, some Democratic county commissioners are also pro ad valorem.

Angela Laws King ran against Castle in 2022.

“Change always brings some degree of positive and negative impacts. As I’ve met with town and county leaders, I’ve learned that the change has been beneficial for the fire districts, other towns and the county while creating a tremendous revenue loss for Boone,” wrote King in an email. “Traditionally, ad valorem benefits rural areas; urban areas are usually benefited by the per capita method of sales tax distribution.”

During the proposal of the change, Geouque, wrote, “The towns would provide, as part of its budgetary process, an amount equal to sixty percent (60%) of the increase in gross revenues accruing to the towns over and above the amount which would have been realized under the per capita method.”

More recently, it was recorded that Beech Mountain makes up 0.8% of the county’s population, but gets 8.2% of the tax distribution. For Blowing Rock it’s 1.6% and 7.9%, and for Seven Devils it’s .36% and 1.2%.

The distribution method faced a legal challenge when the Town of Boone and one of its residents took the issue all the way to the North Carolina Supreme Court.

The Town of Boone and resident Marshall Ashcraft filed against Watauga County in February 2020. Boone argued that the ad valorem method in place was illegal, as smaller unincorporated communities were choosing to remit money that then went back to the county, according to the UNC School of Government.

This suit mirrors another from 1987, where the Town of Beech Mountain filed suit against Watauga County, declaring that the per capita method was unconstitutional. For the fiscal year of 1986-87, Watauga County commissioners decided to shift from the ad valorem to the per capita method.

Ultimately, the superior, or trial, court decided there was no constitutional violation. Beech Mountain took the case to the Court of Appeals, who affirmed the decision. On Feb. 14, 1989, the North Carolina Supreme Court heard the case, stating, “We hold that the per capita distribution offends neither the state constitution nor the federal constitution and, accordingly we affirm the Court of Appeals.”

The case from 2020 followed the same pattern, from superior court, to the court of appeals, and finally the North Carolina Supreme Court. The Court of Appeals determined that there was not anyone whose rights or status was affected by the tax system, and declared that Boone’s “lawsuit raised a non-justiciable political question.” When the case made it to the North Carolina Supreme Court, it was denied a hearing.

“It’s a complicated issue; people don’t understand just how important sales tax is,” Tugman said.